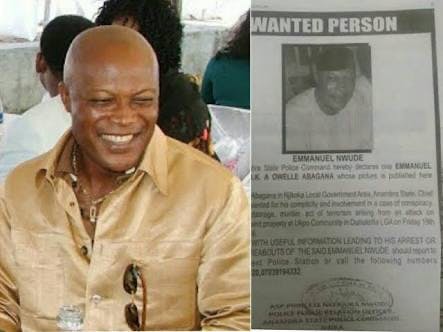

In the late 1990s, Emmanuel Nwude pulled off one of history’s most outrageous cons—selling a completely fictional airport to a gullible Brazilian bank director for a staggering $242 million. This bold scheme, known as the “Nigerian airport scam,” shocked the global banking community and remains one of the most infamous cases of advance fee fraud ever recorded.

The Nigerian Airport Scam: Emmanuel Nwude’s Bold Fraud

Emmanuel Nwude’s elaborate hoax began with a simple but effective deception. He impersonated Paul Ogwuma, the then-Governor of the Central Bank of Nigeria, creating a false identity that carried tremendous authority and credibility. Using this persona, Nwude reached out to Nelson Sakaguchi, a director at Brazil’s Banco Noroeste, with what seemed like an irresistible investment opportunity.

Nwude claimed that Nigeria urgently needed investment for constructing a massive new airport in Abuja, the nation’s capital. He presented Sakaguchi with an exclusive chance to invest $242 million to finance the project—a deal supposedly unavailable to other international investors.

The hook that sealed the deal? A promised $10 million commission fee for arranging the investment—a financial incentive that effectively blinded Sakaguchi to the need for proper due diligence. Sakaguchi never questioned the project’s legitimacy, setting the stage for one of banking’s most costly oversights.

How Emmanuel Nwude Fooled Banco Noroeste

Greed and flattery completely clouded Sakaguchi’s professional judgment. The bank director failed to request construction plans, verify government backing, or conduct even basic checks that would have revealed the fraud. Instead, he chose to trust Nwude’s persuasive persona and promises of exclusivity and profit.

Between 1995 and 1998, Sakaguchi transferred an astonishing $191 million in cash installments from Banco Noroeste, with promised interest covering the remainder of the $242 million total. In return, he received nothing but fabricated progress reports on an airport that existed only in Nwude’s imagination.

Meanwhile, Emmanuel Nwude strategically used the fraudulently obtained funds to purchase significant shares in Union Bank of Nigeria, eventually becoming its highest shareholder. This position further bolstered his credibility in Nigerian financial circles, allowing him to maintain the sophisticated facade while continuing to extract millions from the Brazilian bank.

How Emmanuel Nwude’s Airport Scam Was Exposed

By 1997, Nwude and his co-conspirators had discreetly moved their criminal proceeds to accounts in the Cayman Islands, thinking their scheme would remain undetected. However, the elaborate scam began to unravel through an unexpected channel.

When Spanish banking giant Banco Santander initiated proceedings to acquire Banco Noroeste, their routine due diligence uncovered a shocking financial discrepancy. Santander’s auditors discovered that $242 million—representing approximately 40% of Noroeste’s entire capital reserves—was missing and unaccounted for.

Investigators quickly traced the missing funds to accounts in the Cayman Islands and uncovered their connection to Nwude’s fictitious airport investment. This discovery sparked an unprecedented international investigation, with authorities from Brazil, Britain, Nigeria, Switzerland, and the United States collaborating to dismantle Nwude’s global fraud network. After years of meticulous investigation, Emmanuel Nwude’s elaborate web of deceit finally collapsed.

Emmanuel Nwude’s Arrest and Prison Sentence

As investigators closed in, one of Nwude’s conspirators testified that he attempted to bribe Nigeria’s anti-corruption investigators to avoid consequences. But this time, the brazen con artist couldn’t talk his way out of trouble.

Emmanuel Nwude and his accomplices eventually faced 86 counts of fraud and attempted bribery. Following extended court proceedings, Nwude pleaded guilty to the charges against him. The court sentenced him to 25 years in prison for his central role in the massive fraud. Additionally, he was ordered to repay the millions he had stolen from Banco Noroeste.

Nwude’s story continued after his conviction. He was released in 2006. He then fought legal battles for his seized assets. His claim was that he legitimately acquired these assets before the scam. Legal penalties stripped Nwude of much of his ill-gotten fortune. Yet he reportedly recovered about $52 million. This shows a troubling reality. Sometimes crime can partially pay, despite the consequences.

Impact of the Nigerian Airport Scam on Nigeria’s Reputation

While Emmanuel Nwude’s fraud temporarily enriched him, it caused lasting damage to Nigeria’s international reputation. The high-profile scam reinforced harmful stereotypes linking Nigeria to fraudulent financial dealings. Even today, the infamous “Nigerian prince” email scams that continue to circulate globally can trace their notorious reputation to the international distrust sown by Nwude’s elaborate deception.

This high-profile fraud case unfairly tarnished Nigeria’s reputation. It cast a shadow over countless honest Nigerian citizens and legitimate businesses. Even today, such scams damage how the world perceives Nigeria’s business environment. Many legitimate Nigerian companies now face obstacles when seeking international partnerships.

Lessons Learned from Emmanuel Nwude’s $242 Million Scam

Emmanuel Nwude’s Nigerian airport fraud exposed major weaknesses in the global financial system. It showed how greed can cloud professional judgment. Banks now use this case as a cautionary tale in security training worldwide. It teaches the vital importance of caution, skepticism, and thorough verification steps.

Financial institutions worldwide have strengthened their anti-fraud controls since Nwude’s con. They use his scheme as a textbook example of failed due diligence. Enhanced verification protocols now exist because of lessons from this fraud. Stricter oversight of large transactions came from this case. Even improved international cooperation among financial crime units stems partly from Nwude’s scam.

For individuals and businesses alike, Emmanuel Nwude’s story serves as a powerful reminder to approach too-good-to-be-true investment offers with healthy skepticism. As this case demonstrates, even the most convincing fraudsters can be undone by basic scrutiny and verification. While Nwude’s deceit may have impressed some with its sheer audacity, it ultimately left a damaging legacy of distrust and financial ruin.

Frequently Asked Questions About Emmanuel Nwude

Who is Emmanuel Nwude?

Emmanuel Nwude is a Nigerian fraudster best known for orchestrating the $242 million Nigerian airport scam in the 1990s, one of the largest advance fee frauds in history.

How did Emmanuel Nwude scam Banco Noroeste?

Nwude impersonated Nigeria’s Central Bank governor and convinced Banco Noroeste’s director to invest in a fake airport project in Abuja, collecting $191 million in cash transfers for a non-existent construction project.

Was Emmanuel Nwude arrested?

Yes, Nwude was arrested, faced 86 counts of fraud and bribery, and was sentenced to 25 years in prison after pleading guilty to his role in the $242 million scam.

Where is Emmanuel Nwude now?

After his release in 2006, Nwude reportedly fought legal battles to reclaim some of his seized assets, though much of his fortune was lost. He managed to recover approximately $52 million in assets he claimed were acquired before the scam.

Learn more about other historic financial frauds that changed banking regulations

Discover how to protect yourself from modern advance fee fraud schemes

Additional Facts

Additional Facts

$700,000

The Nigerian Prince scam still steals over $800,000 a year from it’s victims

Every 11 Seconds

A new phishing site is created on the internet every 11 seconds

Over 70%

of people that get a phishing email open the email