BEZOS’ SCRAMBLE TO SURVIVE THE DOT-COM BUST

Today, Amazon rakes in $386 billion yearly as Earth’s most valuable retailer. But 20 years back, critics called it “Amazon.bomb” – certain the company would crumble. When the 2000 dot-com collapse bankrupted competitors, Amazon narrowly dodged disaster itself. Examining those touch-and-go years illustrates how vision and resilience save promising ventures crossing treacherous economic seas.

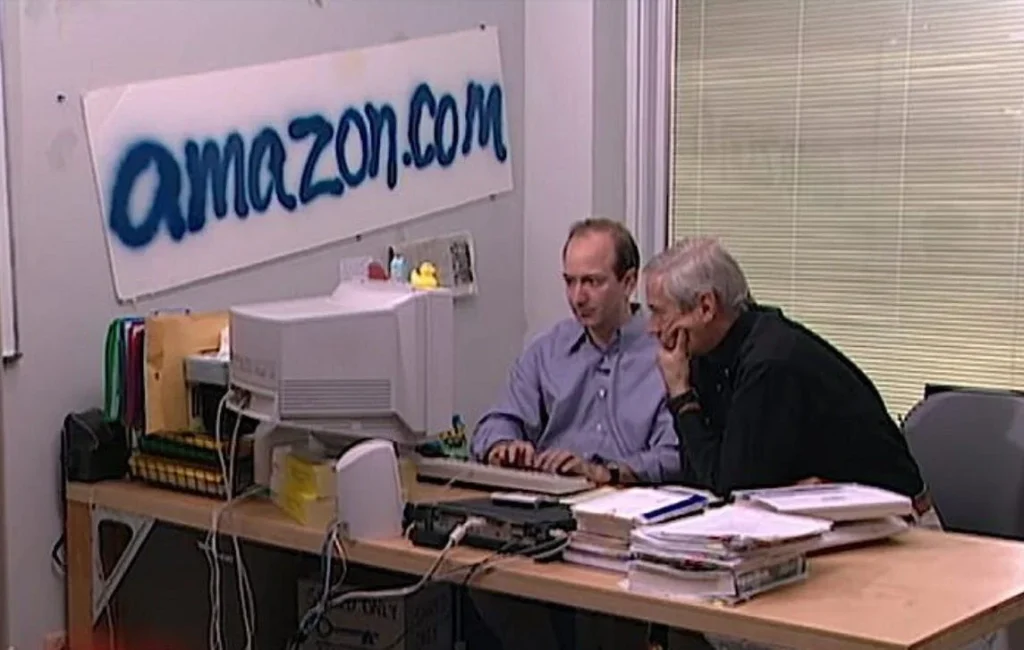

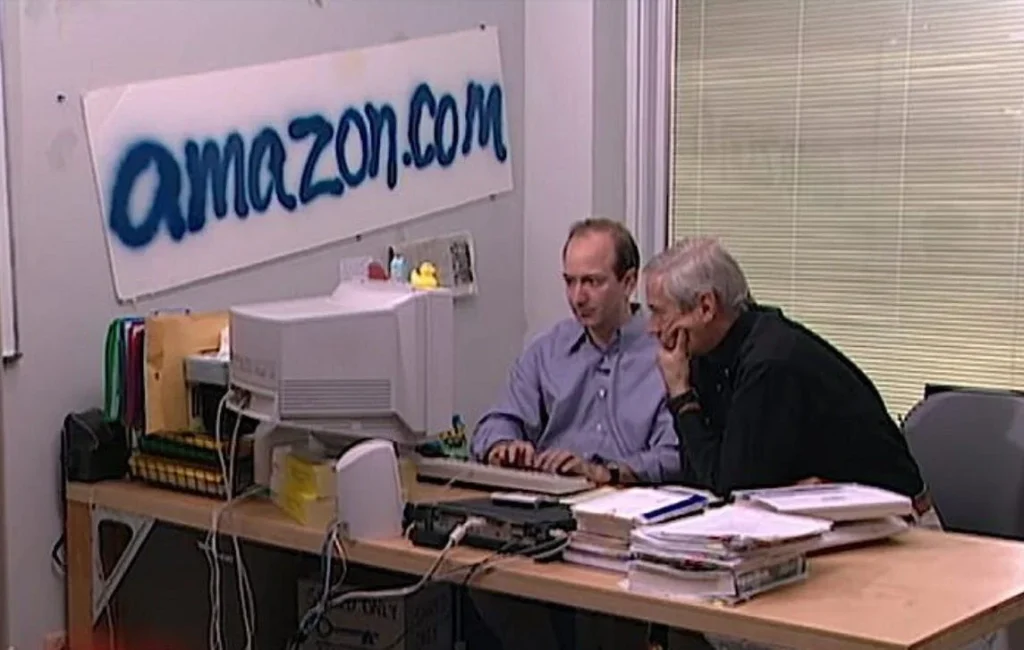

AMAZON – THE “EVERYTHING STORE” IS BORN

Our story starts in 1994 when Jeff Bezos ditched Wall Street to launch an online bookshop called “Cadabra”. Realizing the magic reference spelled trouble, his wife suggested “Amazon” to capture the store’s breadth.

Few customers even used the fuzzy Web then, but Bezos saw unique potential in online retail. Selling books let Amazon develop the technology backbone to possibly sell anything.

Business took off quickly. By 1997, over 180,000 shoppers across 100+ countries fueled around $20 million sales. While traditional booksellers eyed e-commerce cautiously, Amazon charged ahead, expanding inventory and service ambitions.

Media buzzed over this gutsy upstart. But some finance experts scratched their heads – with endless expenses building out systems and warehouses, when would the company ever turn a profit?

AMAZON’S BUBBLE GOES BOOM

In the late 1990s, investors crazily pumped money into untested dot-com companies, betting on the Web’s booming future. Stocks skyrocketed, including Amazon’s value cracking $100 billion despite the firm burning through cash.

In 1999, Barron’s magazine slammed the company as a “worthless scheme” in a cover article titled “Amazon.bomb”. Critics blasted Amazon for caring more about expanding than money itself. They predicted reality would hit hard, with juggernauts like Walmart soon sinking Bezo’s company.

That December, optimistic fervor peaked with millennium New Year’s preparations. But the dot-com bubble was about to explode.

BRINK OF RUIN

In 2000, the dot-com party abruptly ended. Stocks crashed, wiping $1 trillion off the board. Domino bankruptcies wiped out brands like Pets.com.

Amazon stock tanked too. With heavy losses still piling up, skeptics foresaw collapse ahead. Bezos pressed on with focus, but requested staff filter his inbox positive news only.

In 2001, Amazon posted its first profits ever – meager but symbolic that the firm could viably chart its own timing. Competitors folded amidst the massacre, unable to weather the storm.

What most didn’t realize was that Amazon’s negative cash conversion cycle was actually generating cash it could reinvest to stay afloat. With near-instant payment from online shoppers and delaying supplier payments, Amazon enjoyed a built-in financing engine helping it endure the crisis.

DELIVERANCE: PRIME, MARKETPLACE & WEB SERVICES

Previously scattered between various projects, post-meltdown Amazon consolidated around core retail strength.

Prime’s 2005 debut locked in subscriber revenue through shipping guarantees. Third-party Marketplace let Amazon hosts sellers without risks of handling inventory.

Most monumental – Amazon Web Services, launched globally in 2006. The cloud computing platform radically grew Amazon’s business reach. Later AWS revenues became 14% of all sales – supporting retail experiments.

Combined, these pillars leveraged Amazon’s ballooning scale and site traffic into unstoppable momentum. recommendation algorithms improved. Checkout sped frictionless. Dominance seemed inevitable.

After dot-com carnage, Amazon finally gained altitude on essentials before eyeing higher ambitions. Had they narrowly fixated on books or profits, none of this bedrock innovation likely emerges.

DIVIDENDS OF RESILIENCE

Amazon’s saga conveys how outlasting early storms grants winners perspective locking their advantage. Had Bezos wavered when headlines painted certain failure, critics would have “called it” correctly.

Timing and luck matter hugely too – emergency funds before the 2000 crash bought Amazon lifesaving wiggle room. But ultimately, Amazon is still here because leaders persevered through gut-wrenching uncertainty alongside the long-term dream.

With distance, we recognize that game-changing ideas only gather force by incorporating hard lessons. Amazon concentrated on simpler groundworks supporting later envelope-pushing. What customers saw as a bookstore or gadget site stood upon bedrock technology investments perfecting seamless commerce.

Step by step, the foundations fueled momentum uncatchable today. But rewind back 20 years, and pundits foretelling ruins hardly seemed off-base. Until the man at the company’s helm awoke one morning still unwilling to wave the white flag. And a new era for global business stirred.

Emma McIntyre | Getty Images